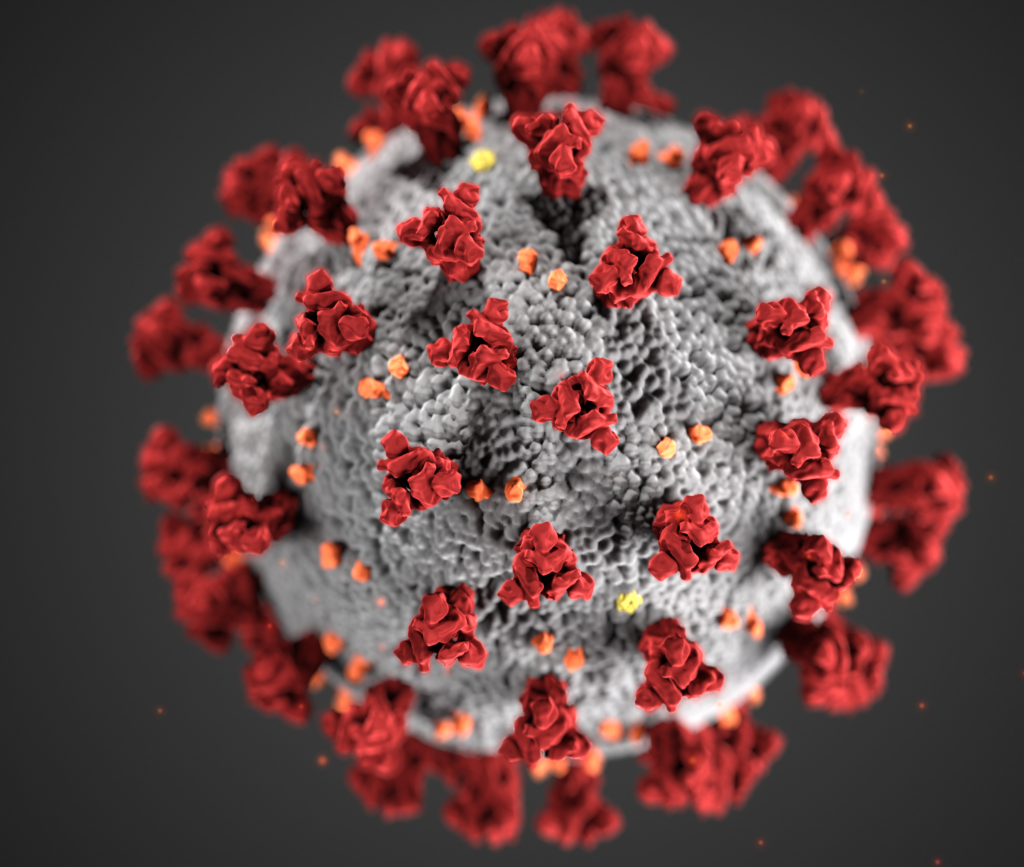

Senior housing in the United States has been hit hard by Covid-19, but one of the largest global real estate investing firms has singled out the sector as a prime opportunity. However, the pandemic complicates a business that already had a high degree of operating complexity, and success will now be even more dependent on sophisticated management capabilities and having a long-term outlook.

In making strategic allocation recommendations in their recently released 2020 Global Outlook report, PGIM Real Estate researchers advised focusing on U.S. senior housing.

The firm’s bullishness on senior housing is due largely to anticipated demand, but the sector is facing a slew of challenges, PGIM Head of Americas Investment Research Lee Menifee told Senior Housing News. Madison, New Jersey-based PGIM Real Estate is the second-largest real estate investment manager in the world and an active investor in the U.S. senior housing market.

“Of all the property types we look at, senior housing has probably the widest division between the near-term outlook and the long-term outlook,” Menifee said.

Near-term pressures include operational and financial challenges due to Covid-19, headwinds related to the broader economic crisis, and reputational damage from being conflated with nursing homes, which have been hit especially hard by the coronavirus. All of these challenges are coming to a head at a time when senior living was already experiencing oversupply, Menifee noted.

However, the long-term prospects for senior housing are bright, due primarily to the surging ranks of aging baby boomers. Still, meeting boomer demand will not be a simple matter, and will largely depend on who can rise to the operational demands of senior living while navigating evolving real estate development trends.

“I think the distinction between winners and losers … it’s always been very wide, but it’s likely to become even wider in the coming years,” Menifee said.

To this end, PGIM will continue to nurture relationships with best-in-class operators as it deploys a fund of nearly $1 billion, Managing Director Steve Blazejewski told SHN.

Analyzing demand

The Covid-19 pandemic does not alter the demographic writing on the wall. In the next decade, the population of people 75 years and older will increase by nearly 50%, to 34 million. Assuming a senior housing adoption rate of 6.6%, new demand will average 41,000 units per year in the next 10 years, according to PGIM’s outlook report.

Popular Reports

“Assuming baseline adoption rates, new supply at the historical average pace of 2.4% would fall short of projected demand by 2025,” the report states. “Even in a scenario in which supply grew by 3.1% per year — as recorded during the past five years — vacancies in the sector fall below their prior cycle low by 2024.”

Senior living residents are older than 75, on average, Menifee acknowledged. Despite this, PGIM has found that demand tracks closely with the 75-plus population.

“If you just look at the 80-plus [population], it’s not explanatory,” he said.

As for the 6.6% assumed adoption rate, PGIM has found that this number has remained “remarkably stable” on a nationwide basis over the last decade, despite some market to market variation, Menifee noted. That adoption rate can drift downward and still generate more demand than has been seen in the last 10 years, but he believes that adoption is more likely to increase as senior housing communities come to be seen as a more widely accepted lifestyle choice.

The timeline suggested by PGIM’s report is also notable, as the firm anticipates that the demand wave will begin to favorably shift market dynamics within the next few years.

“Longer term isn’t that long,” Menifee said. “It’s really looking ahead three to five years.”

That said, investors should not necessarily expect that they can dive into the senior housing market today and assume a profitable exit on a five-year timeframe. Senior living is an operationally complex business in the best of times, and the current environment is especially demanding.

“What we’ve observed in the last few years is really divergent performance across operators and locations,” Menifee said. “As far as we can tell, in senior living, even if you have the right physical product in the right location … the difference in operational expertise seems to explain much, and sometimes all, the performance differences.”

Shifting opportunities

Recognizing that senior living success depends on operations, PGIM will continue its established approach in partnering with best-in-class operating companies, Blazejewski said. However, he wants to nimbly respond to changing conditions in the months and years ahead.

“I do think we’re going to see a bit of a shift in terms of what opportunities are out there,” he said.

In particular, there has been a “very small, even negligible market” for value-add opportunities in the last five to eight years, he said. But this could substantially change over the next 6 to 12 months, as Covid-19 compounds existing oversupply challenges and causes distress.

The nature of that distress could take a variety of forms, Blazejewski believes.

For instance, the firm can pull from its stable of strong partners in order to replace current management, in scenarios where communities are suffering primarily from operational miscues. In other instances, PGIM has acquired and then repositioned assets to have a more optimal unit mix. And, the company can also provide a more favorable capital structure in some cases, when developers and operators are weighed down by leases or other problematic arrangements.

“Our value-add approach is diverse and touches on a lot of different areas,” Blazejewski said, but the ultimate objective is to assemble “sub-portfolios” that tend to be around 5 to 10 properties all under a single operator or manager.

Menifee agrees that value-add opportunities are likely to increase and that investors will find a buyer’s market, but the nature of the distress, the effect on valuations, and the timeline for deals are less clear.

The fiscal and monetary policy actions that the government has enacted, including the massive stimulus packages, have helped maintain a measure of stability, and there is still the potential for financial support to flow directly to senior living coffers.

“It may not play out in the way that happened in the previous downturn, for instance, when you had many bankruptcies of owners and other true distress situations,” Menifee said. “… This may be more of an evolving story over the next year, rather than a lot of things available in the market over the next month or two.”

Meanwhile, the scarcity of deals in the last three months has made price discovery difficult. The dramatic drop in share prices for publicly traded senior housing owners and operators suggests that public market investors view Covid-19 as a more long-term drag on the sector than PGIM believes will be the case. For the moment, Blazejewski is observing a bid-ask spread between buyers and sellers, and he thinks it will take more time and data to create a convergence.

Needs-based assisted living and memory care may bounce back “a little ahead” of independent living, Menifee said. Blazejewski has not yet seen “too much divergence” between assisted living and independent living, though.

PGIM’s outlook analysis did not touch on the growing but still nascent active adult segment, but age-restricted manufactured housing is performing well.

“We’ve seen very stable, steady demand throughout economic cycles, and the current cycle is no exception, where we’re seeing rent collection rates in this environment of 99% or thereabouts,” Menifee said, of 55-plus manufactured housing.

PGIM’s senior housing fund does have flexibility to invest in sub-sectors, and is monitoring trends in areas such as manufactured housing, but the team’s focus has been firmly on more traditional opportunities to this point, Blazejewski said.

Up to 30% of the fund can be invested in ground-up development projects, which is another area of potentially growing opportunity.

“Potentially with a slowdown in construction activity and a possible savings in some construction costs and construction labor, we do think now is a more favorable time to be developing then it was even a couple years ago,” Blazejewski said.

However, Covid-19 could alter some development trends.

Prior to the pandemic, urban senior living projects were on the rise, as were mixed-use developments that incorporated senior housing as a component. Now, the population density of urban centers is seen as a potential infection control risk, while mixed-use projects could be hampered because Covid-19 all but froze retail, hotels and gyms.

Menifee’s viewpoint is that demand for urban living may dwindle somewhat in the years ahead, but this trend was already underway before the coronavirus pandemic, he said. The demographic shift toward the suburbs has been driven in large part by millennials getting priced out of city centers or relocating to start families. The rise of so-called “hipsturbias” in first-ring suburbs has resulted, and Menifee does see these as potentially attractive markets for a variety of real estate types, including senior living.

Mixed-use projects likely will be harder to engineer due to Covid-19, Menifee said. The retail component has historically been the “weak link” in these developments, and that will only be harder in light of retail’s Covid-19 woes, particularly for smaller mixed-use projects that may struggle to gain the critical mass needed for success.

Still, there are always exceptions, and successful projects of all types could flourish if they are well executed, considering the amount of demand on the way. But flexibility and creativity will be key to meet the challenges of today and win over the consumers of tomorrow, which boils down again to the operational complexity of senior living, Menifee said.

“How many times can you say demand is going to double? But, demand is going to double,” he said. “That, to us, suggests there’s an industry that’s going to need to respond to that both operationally as well as developing new products … that maybe requires a rethink of how some existing communities are designed and operated.”

"between" - Google News

June 29, 2020 at 12:45AM

https://ift.tt/3icDLnK

Pandemic Will Widen Spread Between Winners, Losers in Senior Living Business - Senior Housing News

"between" - Google News

https://ift.tt/2WkNqP8

https://ift.tt/2WkjZfX

Bagikan Berita Ini

0 Response to "Pandemic Will Widen Spread Between Winners, Losers in Senior Living Business - Senior Housing News"

Post a Comment