Musk's announcement about the call -- on Twitter, of course -- sent bitcoin surging earlier this week. Prior to the call, Tesla reversed its position on bitcoin, saying it would no longer accept crypto for car payments because of its climate impact.

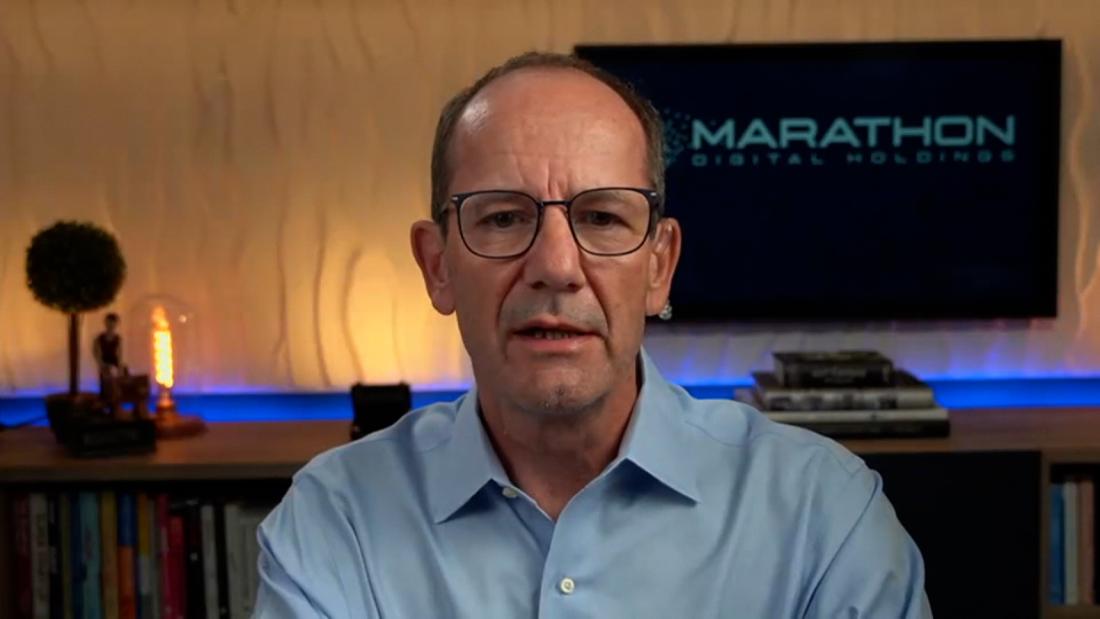

First Move's Julia Chatterley spoke to Fred Thiel, CEO of Marathon Digital Holdings, Wednesday, where he spoke about the call, mining and climate and where bitcoin prices might go.

Can you tell us what happened on that call and perhaps what role Elon Musk played, too?

Thiel: I think the call's purpose really was to help Elon understand really how power is used by the bitcoin mining industry and the bitcoin mining industry's commitment to using carbon-neutral power. Overall our footprint will be 70% carbon neutral. So we're excited to come out and be able to move a majority of our fleet to carbon neutral and, looking forward over the course of next year, to reach 100% overall.

Do you think he was confused about what you guys do and what the implications of what you do beforehand?

Thiel: No. He's a very intelligent man, obviously. I don't think he was confused. I think it is just a question of having the right data at your fingertips. There is a lot of conflicting data out there. The industry is moved or is moving towards 70% carbon-neutral or renewable energy sources, outside of China. The majority of the energy being consumed is moving more towards carbon neutral in the bitcoin industry. One of the reasons for the formation of this group is to be transparent about energy use, to educate the marketplace about how bitcoin mining is really an energy consumer of last resort, how we use a lot of energy that otherwise would be wasted. Bitcoin miners don't consume huge amounts of energy harmful for the environment. A lot are carbon neutral. As we continue to move towards carbon neutrality, we will be an enabler for the industry that provides renewable energy to try new technologies. Part of the meeting was also to try and chat with Elon about what to do to make the industry more reliable.

What do you think he can do to help the industry?

Thiel: Well, Solar City is part of Tesla (TSLA). Solar power generation is something that is a technology they have. Tesla has huge experience in utility scaled battery storage, which is critical to the industry. So I think he clearly has access to technologies that would be helpful, and I think that the industry would love to work with him to try to bring those technologies to greater use, especially for bitcoin mining.

What can you think happens to mining in China. Do you think we see a more significant crackdown?

Thiel: Well, I think we're already starting to see it. Miners in China are starting to either decommission certain mining operations and try and move their operations outside of China and beyond the arm of the Chinese authorities. So I think if you look at the global hash rate, you will see a continued kind of lowering of it to a certain extent over time, until those miners are able to transition.

Does the price of bitcoin matter to your investment plans? Do you have a forecast of where you see bitcoin prices going?

Thiel: I think as you look at bitcoin mining, it is the ultimate scarce resource there is and ever will be. Only 21 million bitcoins available. Today we have about 18.9 million that have been mined. A certain percentage of those have been lost in wallets where people don't have the keys to them anymore. And there are only currently 900 bitcoin made per day or rewarded per day to miners. So the industry is really focused on: the more the price of bitcoin goes up, the more profitable it is, the more incentive people have to go into the mining business. That has two effects. One is the share of rewards decreases on a participant basis as the overall hash rate goes up, which forces the miners to invest in more hardware, more power, et cetera. And we're very focused on maintaining our share in the marketplace. We believe that where bitcoin is today is a good level and it has plenty of runway to go forward. There is certainly good support at the $35,000 level. So our forecast on pricing is it is in a good spot. We think it will get better from an investment perspective.

How much better?

Thiel: We continue to invest. You know, I'm not going to put a $100,000, $1 million price out there. This is a commodity in scarce supply that is still proving its mainstream nature as institutional investors come into the market. As price volatility decreases, the asset will become more interesting to investors, maybe less to speculators. We're focused on bringing these revolutionary technologies like bitcoin and blockchain into the financial markets and into the financial world because there is so much that can be done today using block chain technology. It really is what the internet was in the late '90s. We believe it's that level of revolutionary technology, and it will have a huge impact of everybody's lives.

"between" - Google News

May 27, 2021 at 01:10AM

https://ift.tt/3bX5Yxr

What happened on the call between Elon Musk and bitcoin miners - CNN

"between" - Google News

https://ift.tt/2WkNqP8

https://ift.tt/2WkjZfX

Bagikan Berita Ini

0 Response to "What happened on the call between Elon Musk and bitcoin miners - CNN"

Post a Comment